FAQs

Frequently Asked Questions

Digital Banking

Choose “Deposit Checks” from the left menu and click on “Deposit a Check”. Choose a savings or checking account, enter the amount and then use your smartphone to take a picture of the front and back of the check. You can also upload a check image using a web browser. First, take a picture of the front and back sides of the check, save it to your computer and then follow the steps above to upload the images. Please note that the image needs to be a JPEG/JPG file. PNG file types are not accepted. To convert a PNG file to JPEG or JPG, open the file, select “File”, click “Save As” and choose the JPEG/JPG file type.

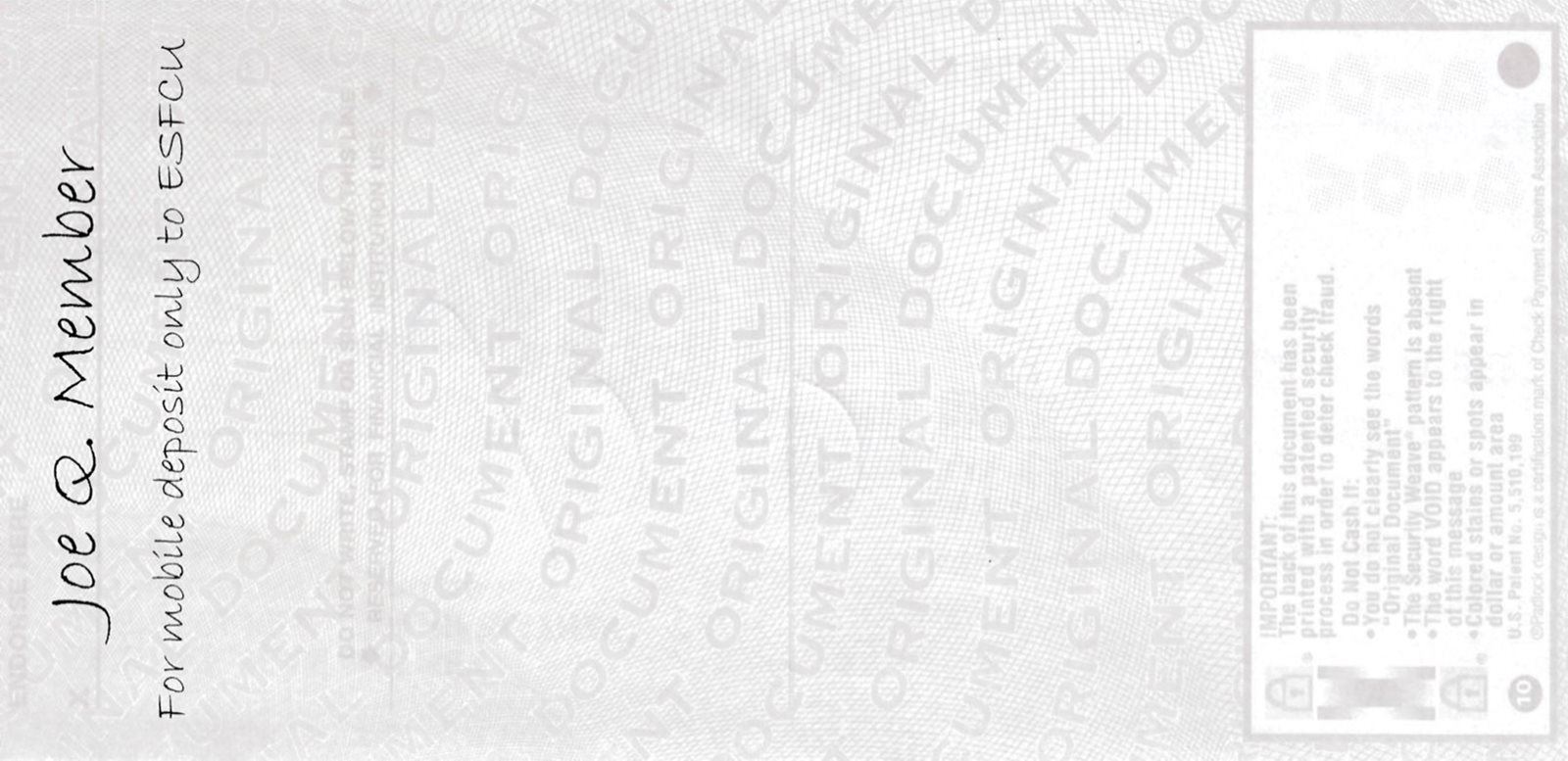

To properly endorse your check, include the following:

Your Signature

For Mobile Deposit Only to ESFCU

For best results, ensure the image of your check is inside the four corners of the box by zooming in or out as needed. The Digital Banking system won’t allow you to proceed unless the image is clear. In addition, use the proper check endorsement as indicated above. Keep the original check for five business days after the deposit is posted as you may be required to submit the original check.

Your deposit may be placed on extended hold and you may be required to submit the original check. Please keep the original check for five business days after the deposit has been made.

The maximum deposit amount is $5,000 per day.

Each check must be deposited individually and requires its own photo. There is no limit to the number of deposits you can make per day as long as the amount is us under the maximum deposit amount of $5,000.

Members can make deposits to checking and savings accounts. Once the deposited funds become available, you can transfer the money to a loan account to make a payment.

You will receive an email when the deposit has been received and a second email when the deposit has been approved.

The Credit Union standard Funds Availability applies to checks deposited through the Digital Banking app. Funds will show as Pending until they are posted to the account. Third party, stale-dated checks and checks that appear to be altered may require an extended hold time. In those cases, you will be notified by letter the day after the funds post to your account.

The Credit Union Funds Availability Policy specifies that deposits need to be submitted before 5:00 pm, Monday through Friday, to be considered deposited on the same day, excluding holidays. Deposits are not posted on holidays, Saturdays or Sundays.